POLICY AND REGULATIONS

State and Local Housing Affordability Policy Tools – WHAT CAN YOUR MUNICIPALITY DO?

Taken from https://housingtoolkit.nmhc.org/wp-content/uploads/2019/04/NMHC_PDF-Sections_Full-Doc.pdf

State and local policies often unintentionally make apartments less affordable. They do this by raising the costs of building and operating these properties, which in turn increases the rent and shrinks the supply of units affordable to middle and low-income residents. Things like policies that require density reduction, property tax increases, infrastructure requirements such as stormwater retention systems, review delays, and community exactions like assessing impact fees, “in-lieu” fees, construction of public improvements, and land dedication for public use, such as a new park, school site, or road widening, all lead to increased costs for development, and therefore increased rents for individuals wishing to live in those units. Balancing the need to ensure new housing development “pays its own way” with the need for affordability is a huge undertaking. Governments at the state and local levels need to evaluate how their policies impact housing affordability, paying close attention to their combined effects on the community.

State and local policies often unintentionally make apartments less affordable. They do this by raising the costs of building and operating these properties, which in turn increases the rent and shrinks the supply of units affordable to middle and low-income residents. Things like policies that require density reduction, property tax increases, infrastructure requirements such as stormwater retention systems, review delays, and community exactions like assessing impact fees, “in-lieu” fees, construction of public improvements, and land dedication for public use, such as a new park, school site, or road widening, all lead to increased costs for development, and therefore increased rents for individuals wishing to live in those units. Balancing the need to ensure new housing development “pays its own way” with the need for affordability is a huge undertaking. Governments at the state and local levels need to evaluate how their policies impact housing affordability, paying close attention to their combined effects on the community.

Excerpts and Highlights from the National Multifamily Housing Council - The Housing Affordability Toolkit

Incentives

Housing Development Incentives are local policies designed to stimulate the development of housing. A local government can deploy a variety of mechanisms providing direct and indirect forms of support to incentivize the development of housing. The goal of these incentives is to increase revenue streams or decrease costs for a specific development, which increases the project’s likelihood of being developed.

Housing Development Incentives are local policies designed to stimulate the development of housing. A local government can deploy a variety of mechanisms providing direct and indirect forms of support to incentivize the development of housing. The goal of these incentives is to increase revenue streams or decrease costs for a specific development, which increases the project’s likelihood of being developed.

Start by prioritizing the following for your community:

- Lower Rent: Does your community wish to provide incentives in exchange for lower rents?

- Increased Supply: Does your community wish to increase the supply of rental housing to reduce the demand pressure on existing units?

- Production: Does your community wish to expand production, diversify production, or accelerate production?

Types of Incentives

Regulatory Incentives

-

Density bonuses

-

Flexible design standards

-

Reduced parking requirements

-

Accelerated approvals

-

By-right development

Explained:

-

Relatively inexpensive and straightforward to implement

- Can be less effective than direct funding in increasing new housing by large amounts.

Funding Incentives

-

Reduced fees

-

Public land

-

Tax Incentives

- Public financing

Explained:

- Provide money directly or indirectly from public reserves

- Can be significant or even necessary for a project to be feasible for development

Tool for Developing Higher-Density, Multi-Family Housing by Right Development (Pages 63 – 73 of the Toolkit)

By-Right Development: A housing development policy that prioritizes the development of higher density multifamily housing through uniform, codified, and consistent zoning and development regulation. Establishing by-right development allows the supply of housing to grow with demand and helps to stabilize and lower rents.

Public Land Policy (Pages 86-95)

Selling public land at a below-market price to subsidize the development of housing can improve affordability in a community.

To design an effective public land policy, a city should take a three-tiered approach.

Tier 1: Include a Broad Portfolio of Publicly Controlled Land

Public Land Policy (Pages 86-95)

Selling public land at a below-market price to subsidize the development of housing can improve affordability in a community.

To design an effective public land policy, a city should take a three-tiered approach.

Tier 1: Include a Broad Portfolio of Publicly Controlled Land

-

Apply a public land policy to land held by all governmental departments and quasigovernmental agencies (e.g., transit or redevelopment agencies, housing authorities, municipal utilities, school districts, etc.)

-

Prioritize high-value sites, rather than exempting sites in desirable areas.

-

Encourage co-location of housing and government facilities, including redesigning public facilities.

-

Conduct a thorough inventory of land to understand availability and barriers.

-

The more land value contributed to a project, the greater the affordability.

-

By allowing mixed-income, high-density developments on high-value sites, public land policies can create more affordability.

-

Public land can be used to model and catalyze the type of mixed income development a local government wishes to see more of in the market.

- Affordability can also be supported through ‘fast tracked’ regulatory processes, reducing uncertainty and development costs that threaten affordability

Tier 3: Follow a Defined Selection Process

-

The best selection processes will be clear and simple enough to attract a broad range of developers and competitive proposals, ensuring that a local government can get the best possible public value from a discounted land sale.

-

Public benefits and affordability goals must be detailed and specific, helping developers strengthen their proposals.

- Early and effective community engagement is critical to a successful public land policy. Engagement can help to create a broadly supported selection criteria and prevent eventual community opposition to development.

Tax Abatement Tool (Page 96-104)

To design effective PROPERTY TAX incentives, a city should take a four-tiered approach.

Tier 1: Create a Defined and Feasible Approach to Increase Affordability.

Tier 2: Balance Affordability Requirements with Incentives

Tier 3: Carefully evaluate the period of the incentive to ensure that it aligns with the larger policy goals of the incentive.

Tier 4: Enable Simple Administration and Developer Participation.

Tier 1: Create a Defined and Feasible Approach to Increase Affordability.

- Tax incentive policies should not only be limited to units that receive other federal and state subsidy sources.

- Tax incentives should be geographically targeted based on market conditions.

- The flexibility of tax incentives should be used to create an approach customized to a market. In markets where the supply of housing is limited by a lack of developable land, a direct approach is best.

Tier 2: Balance Affordability Requirements with Incentives

- Successful tax incentives can have economic, fiscal, and policy benefits that outweigh the implementation costs and foregone tax revenue.

- Property tax incentives with a direct approach should set the incentive to match the level of affordability the policy is aiming to achieve.

Tier 3: Carefully evaluate the period of the incentive to ensure that it aligns with the larger policy goals of the incentive.

- To target deeper levels of affordability through a property tax abatement, incentives should allow tax reductions for market-rate units to cross-subsidize units at deeper levels of affordability.

Tier 4: Enable Simple Administration and Developer Participation.

- Tax incentives should rely on a rule-based approval process. These programs should be designed to work in tandem with an existing development process that is predictable and limits discretionary review.

- Administrative simplicity influences the ability of tax incentives to be effective.

- Policies should keep income documentation and reporting requirements simple and should not replicate burdensome federal requirements.

- Resident selection processes should not impede the process of filling rental housing.

What NOT to DO – RENT CONTROL:

Rent control is a counterproductive housing policy that does not address any of the key factors driving housing affordability.

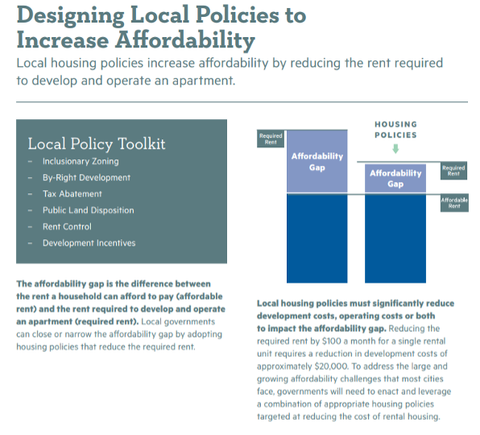

Local governments have many tools at their disposal that can decrease the affordability gap and increase overall supply.

-

Rent control leads to a decrease in supply of overall units and an increase in rents for unregulated units.

-

Rent control is a blunt tool that does not efficiently target benefits.

- Rent control is complicated and expensive to administer.

Local governments have many tools at their disposal that can decrease the affordability gap and increase overall supply.

-

Rent vouchers can help increase what households can pay for units.

- Tools like property tax incentives, public land subsidies, and other developer incentives can decrease the cost to develop and operate housing, while expanding by-right development can help increase overall supply.

Resources

DevelopOhio Resource Center & the Economic Incentives Tookit

Ohio’s Downtown Redevelopment Districts (ORC Section 5709.45)

Ohio's downtown redevelopment districts are designated areas that use new property tax growth to fund the revitalization of historic business districts. These districts capture increased property tax revenue to support projects like rehabilitating historic buildings, improving public infrastructure, and creating jobs. Key features include being no larger than 10 acres, requiring at least one historic building, and having the potential to create an "innovation district" within the larger area for high-tech businesses.

BACK

NEXT